UNDER the Income Tax Act, 1961, a resident in India has to pay taxes in India on his/her global income earned during the previous year. On the other hand a non resident in India who has earned income in India can't be spared from his tax liability under this act and therefore has to pay taxes on the income which is earned in India. So, here goes the saying, “In this world nothing can be said to be certain, except death and taxes." – Benjamin Franklin.

Various provisions have been made in Income Tax Act, 1961 to levy and collect taxes from Non-Residents and the most prompt way to collect such taxes is to oblige the payer to withhold the tax or deduct the tax on such payment being made to Non-Resident. At the outset, it is

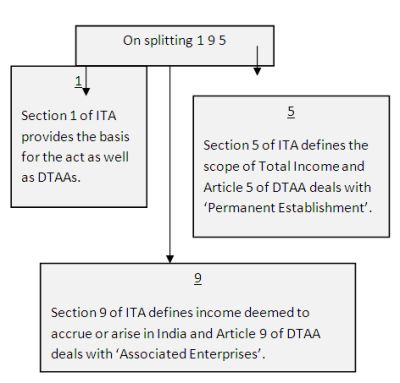

imperative to mention that though section 195 deals with deduction of tax in case of non residents but virtually every section and provision of the act and article of DTAA has to be considered and applied in the context to determine the taxability, taxable amount and the applicable rate. Before setting on to section 195, reference of some very relevant sections needs to be given.

Believe it or not

Section 195 of the Act takes it essence itself from the following sections of the act and articles of DTAA.

What an analogy! Surprisingly, above mentioned sections and articles are conditions precedents to the determination of the fact whether TDS is applicable or not. These will be also dealt with after explaining the fundamental provisions of section 195.

What is meant by Non-Residents?

Under Income Tax Act, non-residents or non-resident in India can be of two types:-

(a) Non-resident Indian - "Non- resident Indian" means an individual, being a citizen of India or a person of Indian origin who is not a "resident".

(b) Any other non-resident person – It will include Foreign Nationals or foreign companies.

Section 195: Other sums (i.e. TDS on payment to non-residents)

“Any person responsible for paying to a non-resident, not being a company, or to a foreign company, any interest or any other sum chargeable under the provisions of this act shall at the time of credit of such income to the account of payee or at the time of payment thereof in cash or by the issue of a cheque or draft or by any other mode, whichever is earlier, deduct income tax thereon at the rates in force."

After a bare reading of the above, let us interpret the above catch note of section 195(1).

Who is liable to deduct tax?

Any person as defined in section 2(31) shall deduct tax, which would include residents as well as non residents. This means that non-residents are also obliged to deduct tax. This has also been provided by way of clarificatory retrospective amendments in Finance Act, 2012.

Who shall be the recipient?

The section covers all non residents in its ambit as others have been covered under other sections.

At what rate tax shall be deducted?

The tax shall be deducted at the rate or rates in

force as defined u/s 2(37A) i.e. the rate or rates of income-tax specified in this behalf in the Finance Act of the relevant year or the rate or rates of income-tax specified in an agreement entered into or notified by Central Government u/s 90 and 90A.

When the tax should be deducted?

As is evident from above tax shall be deducted at the time of payment thereof in cash or by the issue of a cheque or draft or by any other mode, whichever is earlier. Further, the payer is bound to deduct tax at source only if the tax is assessable in India. If tax is not so assessable, there is no question of tax at source being deducted. [Vijay Ship Breaking Corporation v. CIT - (2008-TII-07-SC-INTL)]

What is the threshold limit for deduction of tax?

There is no such threshold limit and tax is deductible even if payment is negligible.

At what amount tax shall be deducted ?

This point has been effectively dealt with by the Apex Court in Transmission Corporation of A.P. Ltd. and Another v. CIT reported in - (2002-TII-01-SC-INTL) in which SC opined as under :

1. Tax is deducted on ' any sum' on which income tax is leviable. That sum may be income or income hidden or otherwise embedded therein.

2. Scheme of TDS just not only applies on amount paid which wholly bears “income" character such as salaried, dividend, interest on securities but also to gross sums the whole of which may not be income or profits of recipient, such as payment to contractors

3. The said TDS provisions are meant for tentative deduction of income-tax subject to regular assessment .

Following points also need consideration:

As mentioned in section 195(2) and clarified by CBDT Circular No. 152 dated 27-11-1974 that where whole of the sum being paid would not be income chargeable to tax in the hands of recipient non-resident, person responsible for paying such sum may make application to AO for determination of appropriate portion of such sum which is so chargeable and tax to be deducted accordingly.

New sub section (7) has been inserted in section 195 w.e.f. 1.7.2012 wherein it has been provided that CBDT may, by notification specify a class of persons or cases, where the person responsible for paying any sum to a non-resident, whether taxable or not, shall make an application to the Assessing Officer to determine appropriate proportion of sum chargeable to tax.

Objective of Section 195

As it clear from above discussion and circular that tax due from non-resident persons should be secured at the earliest point of time so that there is no difficulty in collection of tax subsequently at the time of regular assessment. This will obviate the difficulty in chasing such foreign nationals for recovery of their tax dues subsequently, due to jurisdictional and other operational difficulties. Further most such foreign nationals are likely to have nil or at best very meager assets in India which may be totally inadequate to recover the tax dues.

Section 5(2): Scope of Total Income of Non-Resident

It covers any income which is received or is deemed to be received in India or any income which accrues or arises or is deemed to accrue or arise in India u/s 9 of Income Tax Act, 1961.

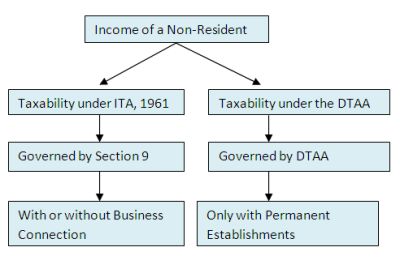

Taxability of Income of Non Resident under ITA, 1961 vis-à-vis DTAA

To prevent double taxation of the same income in the source and home country, Double Taxation Avoidance Agreements have been entered into with several countries for granting double taxation relief. The position of law is that the DTAA entered into by GOI overrides the domestic law. This has been clarified by CBDT vide Circular No. 333 dated April 2, 1982. Therefore, the income will be chargeable as per the provision of Income Tax or DTAA whichever is more beneficial to the assessee, if there is treaty between India and other country. If there is no treaty available then it shall be taxed in India as per the provisions of the ITA, 1961.

Section 9: Income deemed to accrue or arise in India

Section 195 derives its form and substance completely from section 9. Section 9 which inter alia includes the concept of business connection, royalty and fees for technical services is fraught with issues and controversies and has seen various amendments from time to time, many of them were binding in a retrospective manner.

(a) Income from a business connection in India [Section 9(1)(i)]: Any income which arises, directly or indirectly, through or from any activity or business connection in India is deemed to be earned in India.

Business Connection (BC) : BC is the Indian equivalent of PE and also broader in connotation and is used effectively to tax the income of Non-Residents in India. Business connection may be in several forms e.g. branch or subsidiary in India carrying on business of its head office or parent company located outside India would also be a business connection in India. Any profit of non -resident which can be reasonably attributable to the such part of operations carried out by its business connection in India are deemed to be earned in India [Explanation 1 to Section 9].

The landmark judgment of the Andhra Pradesh High Court in GVK Industries Ltd. v. ITO 2003-TII-239-HC-AP-INTL has laid down following principles which needs to be satisfied in order to constitute BC:

++ Existence of close, real and intimate relationship++ Commonness of interest++ Continuity of activity or operation++ A stray or isolated transaction is not enough to establish a business connection [Anglo French Textile Co Ltd v CIT - (2002-TII-09-SC-LB-INTL)]

In Blue Star Engineering Co. (Bom) Pvt. Ltd. Vs CIT - (2003-TII-75-HC-MUM-INTL) it was held that the expression “Business connection" is a expression of wide and indefinite import and is different from the expression “business" as defined under the Act .

It has been clarified by Circular No. 23 dated 23-7-1969* that the income from the transaction will not be deemed to accrue or arise in India under section 9 provided that the sales are made on a principal-to-principal basis and at arm's length price.

Despite being referred to in the ITA, the term was not defined till the Finance Act, 2003 inserted somewhat cryptic definition of BC wherein certain situations amounting to BC has been provided if business activities are carried out by any person in India acting on behalf of Non-Resident subject to certain exceptions.

Commission paid to Non-Residents

In CIT v. Toshoku Ltd., (2002-TII-03-SC-INTL), in Ind. Telesoft - (2004-TII-02-ARA-INTL) and in host of other decisions it has been held that area of operation or activity of such agents is outside the country and so no part of income arises in India as there is no business connection in India. Such a position has also been clarified by CBDT vide circular no. 23 dated 23-7-1969* and 786 dated 7-2-2000* .

* Note: CBDT vide circular 7/2009 dated 22-10-2009 withdrew all 3 circulars as their language was not interpreted right in many cases in light of Section 9 :

(i) 23 dated 23-7-1969(ii) 163 dated 29-5-1975(iii) 786 dated 7-2-2000

However, withdrawal of the aforesaid impugned CBDT circulars would not affect the existing settled position in law and it has been upheld in DCIT v. Divi's Laboratories Ltd. - (2011-TII-182-ITAT-HYD-INTL).

(b) Income from any property, asset or source of income situated in India [Section 9(1)(i)]: Any income which arises from any property movable or immovable, tangible or intangible which is situated in India, is deemed to accrue or arise in India.

Example: R who lives in London, has a house property situated in India which has been given by him on rent. Rent derived by R shall be taxable in India whether such rent is received by him in India or outside India as the house property is situated in India.

(c) Income through transfer of any capital asset situated in India [Section 9(1)(i)]:

Section 9 which codifies the source rule of taxation has gone through many changes.

The scope has been widened by inserting the deeming 'look through' provisions as against 'look - at' approach retrospectively w.e.f. 01-04-1962 through explanations to nullify the decision of SC in Vodafone International Holdings B.V. v. Union of India - (2012-TII-01-SC-INTL).

Newly inserted Explanation 4 states that the expression "through" shall mean and include and shall be deemed to have always meant and included "by means of", "in consequence of" or "by reason of".

Similarly, Explanation 5 clarifies that an offshore capital asset would be considered to have a situs in India if it substantially derives its value (directly or indirectly) from assets situated in India.

The above drastic provisions introduced after lifting up the corporate veil are like travelling back in time machine and has compelled to withhold tax in Vodafone and other related cases.

(d) Any income which falls under the head 'Salaries' if it is earned in India [Section 9(ii)]: Any income payable for services rendered in India shall be regarded as income earned in India though it may be paid in India or outside. However, if salary is payable by GOI to an Indian citizen/national for rendered outside India it shall also be the income deemed to accrue or arise in India [Section 9(iii)].

Reimbursement of salary cost payable to the employees of foreign company: In ITO v. M/s Ariba Technologies (India) Pvt. Ltd. [ITA No. 616 (Bang) 2011], it was held that since the employees were under the direct control and supervision of the Indian company therefore reim bursement of salary cost to the foreign company should not be subject to tax withholding u/s 195 of the Act, provided the Indian company has duly withheld taxes u/s 192.

(e) Income by way of interest/royalty/ FTS [Section 9(1)(v)/(vi)/(vii)]: Vide Finance Act, 1976, a source rule was provided in section 9 through insertion of clauses (v), (vi) and (vii) in sub-section (1) for income by way of interest, royalty or fees for technical services respectively. It was provided, inter alia , that in case of payments as mentioned under these clauses, income would be deemed to accrue or arise in India to the non-resident under the circumstances specified therein.

The intention of introducing the source rule was to bring to tax interest, royalty and fees for technical services, by creating a legal fiction in section 9, even in cases where services are provided outside India as long as they are utilized in India.

By the Finance Act, 2010; the Legislature retrospectively amended the Explanation to section 9 of the Act from 01.07.1976 ( which was inserted retrospectively only vide the Finance Act, 2007 ) to reiterate the taxability of income by way of interest, royalty and FTS, under the principle of 'source rule of taxation'. This was done with a view to reverse the findings of the Apex Court in the cases of Ishikawajima-Harima Heavy Industries Ltd. v. DIT, (288 ITR 408) - (2007-TII-01-SC-INTL) and the Karnataka High Court in the case of Jindal Thermal Power Company Ltd. v. DCIT (TDS),- (2009-TII-16-HC-KAR- INTL) on the issue of taxability of FTS in India u/s 9 of the Act. The Legislature amended the language of the Explanation to provide that situs of rendering of services was not relevant in determining the taxability of the aforesaid income u/s.9 of the Act. The Memorandum explaining the Finance Bill, 2010 specifically stated the intention of the Legislature to tax the fees from technical services which are provided from outside India as long as they are utilised in India. So, if it is utilised in India, tax has to be deducted.

PE Concept

Under DTAA, tax is required to be deducted if there is PE in India. The PE concept marks the line of demarcation between trading with a country & trading within a country. In different DTAAs, PE has been defined in Article 5 differently but fundamentally the term permanent shall include:

(a) a place of management;(b) a branch;(c) an office;(d) a factory;(e) a workshop;(f) a mine, an oil or gas well or a quarry(g) a warehouse in relation to a person providing storage facilities for others;(h) a farm, plantation or other place where agricultural, pastoral, forestry or plantation activities are carried on;(i) premises used as a sales outlet or for receiving or soliciting orders;

PE has been defined in DTC Bill u/s 314(183) more or less on the same lines as above.

In general to constitute a PE AAA rating i.e. following tests should be satisfied:

++ A sset test++ A gency test++ A ctivity test

After discussing above provisions and applicability of TDS in each of them, following jurisprudence are noteworthy:

++ Interest on notified securities held by a non-resident including income by way of redemption of such bonds or interest on Non-Resident (External) Account in any bank in India, in case of an individual is not taxable by virtue of section 10(4) and hence no tax should be deducted.

++ Payments for training of staff

In AAR - Ericsson Telephone Corporation India AB, INRE 269 of 1996 - (2002-TII-09-ARA-INTL) payments were made for installation of the system of cellular communications in India & also to impart necessary knowledge and training to Indian personnel for the continued operations of the system in India. Held that the non-resident is rendering technical and consultancy services in India in the field of its specialty and hence the remuneration is FTS and tax needs to be deducted.

++ Payments for “know-how" and/or “information"

In CIT vs. Davy Ashmore India Ltd. - (2003-TII-26-HC-KOL-INTL), outright purchase of property was

held not to be a royalty & in Swadeshi Polytex Ltd. vs. ITO - (2003-TII-41-ITAT-DEL-INTL) use of property was held to be royalty. These two decisions draw a fine line between transfer of right in a property and use of property.

++ Shrink wrapped software amounts to royalty: Assessee having imported shrink wrapped software from non resident companies under software license agreement whereby license is granted to assessee for taking copy of the software, store the same in the hard disk, to take back up copy while the ownership of the copyright continues to vest in the hands of supplier, there is only transfer of the right to use the copy of software and hence payment to supplier amounts to royalty and TDS has to be deducted. [CIT v. Samsung Electronics Company Ltd. reported in - (2011-TII-43-HC-KAR-INTL)]

++ Payment to a resident agent of a Non resident shipping company:

In such a case section 172 will apply and not 195 on the basis of Generalia specialibus non derogant.

Hurray!! - Govt. clears the air on tax exemption to Indian Outsourcing Firms

After the controversial General Anti- Avoidance Rules (GAAR), the Finmin sought to clear the air on taxation of software companies through a set of clarifications, thereby allowing the Indian Inc. to claim tax exemption on software development at client's office overseas. India's USD 100 billion IT outsourcing sector, which earns the bulk of its revenue from exports of software services, won a long-sought battle and favourable clarification over the tax treatment of some of the money it earns abroad. Therefore, profits from software being developed overseas by Indian companies and from fees for sending staff abroad to client locations will get the same exemptions that the industry gets at home under the Law of the Land. This exemption would serve as a huge relief to India's leading ICT giants- such as Infosys and Wipro. Earlier there was some disputed contention from the Income tax department that such transactions “body shopping transactions", as the work was not undertaken in India and refused to treat it as a software exports. Thanks to an expert Committee headed by former CBDT chairman, N Rangachary, which opined to treat such transactions in the category of “deemed exports". This Herculean clarification will definitely result in resolving the endless disputes over this matter

Provisions of Finance Bill, 2013

Following is the gist of such provisions:

1. Tax to be deducted at a concessional rate of 5% on interest payable to a non-resident in case of certain rupee-denominated long-term infrastructure bonds issued by an Indian company in India.2. Tax @ 5% on income distributed shall be payable in respect of income distributed by an infrastructure debt fund, whether set up as a mutual fund or a NBFC, to a non-resident investor.3. The Bill provides increase in rate of tax on royalty and fees for technical services for non-resident tax payers under the Income Tax Act from 10% to 25% in respect of agreements entered into after March 31, 1976. This would increase the rate of tax of royalty and fees for technical services paid to non-residents where income is taxable under the provisions of the Act. Non-residents can continue to avail of lower tax rates under the DTAA, where applicable Tax treaties such as those with Netherlands and Singapore prescribe for a lower tax withholding of 10% will continue.

To sum up

Each and every transaction with non-resident on which tax has to be deducted involves consideration to ITA, 1961 as well as DTAA. After understanding the applicability of TDS, it has to be deducted at the rate as mentioned in Finance Act or DTAA whichever is beneficial to the assessee (not dealt with in this article as my focus point has been “applicability" of TDS provisions on payment to non-residents). Efforts have been made to discuss the prominent and practical issues out of the plethora of possible issues. Due to frequent amendments and increasing cross border transactions, this aspect of International Taxation is highly dynamic, challenging and beyond the limit.

1 comment:

Hey Manish !!!

Very well written ,but would love to hear your views over the section 206AA and increased % of Royalty to 25%.

Waitig for your response

Thanks & Regards

Ankita Bhowmik

Post a Comment