What the rule says?

Bar against direct demand on assessee.

- Where tax is deductible at the source under the foregoing provisions of this Chapter, the assessee shall not be called upon to pay the tax himself to the extent to which tax has been deducted from that income.

What is TDS?

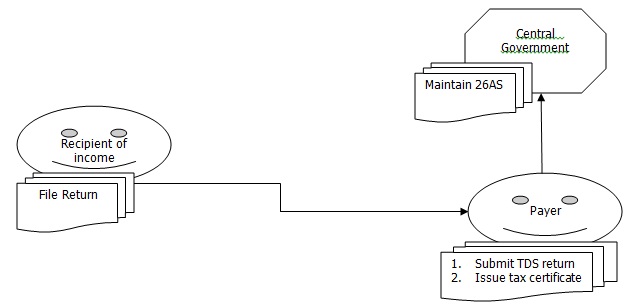

Under the tax recovery scheme of “Tax Deduction at source” or TDS, person responsible for making payment of income, covered by the scheme, is responsible to deduct tax at source and deposit the same to the government.

The position of amount deducted as TDS under income tax act is as below:

- The TDS so deducted is part of the total gross income of the assessee.

- The recipient of income – though gets only the net amount – is liable to tax on the gross amount.

- Thus, amount deducted at source is subtracted against the assessee final tax liability. This facility is know as – “Credit of tax deducted” and available in the following manner:

- Credit of tax deducted and paid to the central government, shall be given to the deductee for the assessment year for which such income is offer for assessment.

- Where income is assessable over a number of years, credit for the tax deducted at source shall be allowed across those years in the same proportion in which the income is assessable to tax.

- If the income is assessable in the hands of a person other than the deductee, then credit will be given to such other person.

Position of recipient of income after he receives TDS deducted income from payer:

Depending upon the circumstances of the case position of the receiver of income may be any of the following:

- No TDS have been deducted on his he received

- TDS have been deducted but no TDS certificate is issued to the assessee

- The person who has issued tax deduction certificate has been refunded tax

- TDS certificate has been issued but same is not appearing in Form No 26AS

- The TDS deductor has not remitted tax deducted to the government

- Deductor has not paid TDS but deductee has correctly paid tax on his total income.

Case 1: No TDS have been deducted-

In case deductor had not deducted TDS than there is no problem. Receiver of income shall compute tax liability in normal manner and pay his liability to central government.

Case 2: TDS have been deducted but no TDS certificate is issued to the assessee-

In view of section 205, under no circumstances, assessee is liable to make payment of any tax to the extent to which such tax had been deducted at source by the person paying income to the assessee. Hence income tax authorities cannot recover tax from the assessee.

Case 3: Tax has been refunded to the payer-

As assessee (from whose receipts tax has been deducted at source and who is also in possession of Form No 16/16A) must get credit of tax deducted at source and such credit cannot be decline merely on the ground that person who has issued tax deduction certificate has been refunded tax which he has deposited with the government.

Case 4: Tax credit is not appearing Form No 26AS:

This case may occur due to any mistake in filling return by deductor or in case PAN no is not furnished to him. If tax is deducted and TDS certificate in Form No 16/16A/16B is issued, credit of TDS can not be denied to the recipient solely on the ground that such credit does not appear in Form No 26AS.

Case 5: The TDS deductor has not remitted tax deducted to the government

Under such circumstances receiver of income will not have any control on the deductor to see if the tax deducted from his payment has been ultimately remitted to the government or not.

Thus, department does not have the option against the recipient but to allow him the credit. Means receiver of income shall be allowed to deduct TDS amount from his tax liability.

However, department may proceed against the deductor by holding him assessee in default.

Case 6: Deductor has not paid TDS but deductee has correctly paid tax on his total income (without claiming tax credit)

Where recipient of income has already paid taxes on amount received from deductor, department once again cannot recover tax from deductor on the same income by treating deductor to be assessee in default.

However, in the case of default, the payment of interest is mandatory for the period of delay caused by the omission for the tax to reach the government.

In short position in law is –

EITHER RECEIVER INCOME OR PAYER OF INCOME DEPOSIT THE TAX TO GOVERNMENT.

DEPARTMENT WILL CLAIM ONLY INTEREST FOR THE PERIOD OF DELAY.

No comments:

Post a Comment