TRACES stands for TDS Reconciliation Analysis and Correction Enabling System and has been set up by TDS Centralised Processing Cell of the income-tax department.

TRACES will integrate the following components

- Tax information Network

- Automated TDS Challan Matching

- TDS Defaults Processing

- IVR/ Call Centre

- Web Portal

New Web Portal : https://www.tdscpc.gov.in

The new portal has been created using latest technology to enhance swift interaction between the deductor,

deductee, income-tax department and CPC. The following features are/ will be available to deductors and deductees

- Dashboard giving summary of Deductors account

- Online registration of TAN

- Online filing of TDS Statements

- Online corrections of TDS statements

- Default Resolution

- View Form 26AS

- Download Form 16/16A/Consolidated TDS File

- Grievance registration and resolution

Not all of the above features have been activated so far

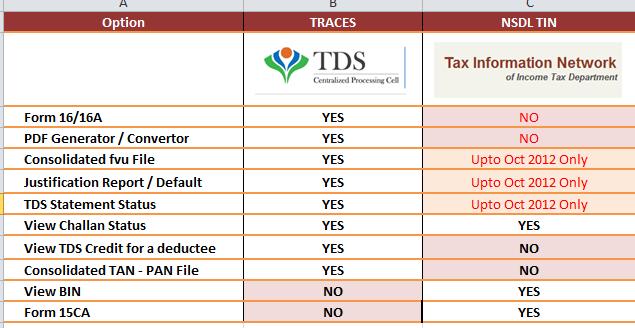

NSDL web site V/s TRACES web Site : Current Status

Currently several online services are provided to deductors and deductees on TIN site by NSDL. The following table presents various services at both the sites

Registration at TRACES

- Users who have already registered at NSDL TIN site, need not register again on TRACES. Their registration details are migrated and they can login at TRACES with their NSDL-TIN login details

- Fresh registrations on NSDL site have been stopped

- New registrations can be done at TRACES site and online help is available under the FAQ link

It appears; gradually TRACES will become the only site for deductors and deductees. As more features appear and existing features understood, we will keep sharing the information with you.

1 comment:

What is the meaning of reconciliation in Accounting area?

I want to know details of reconciliation , Service Tax , TDS , VAT and other important information in Accounting area.

PPI Claims Made Simple

Post a Comment