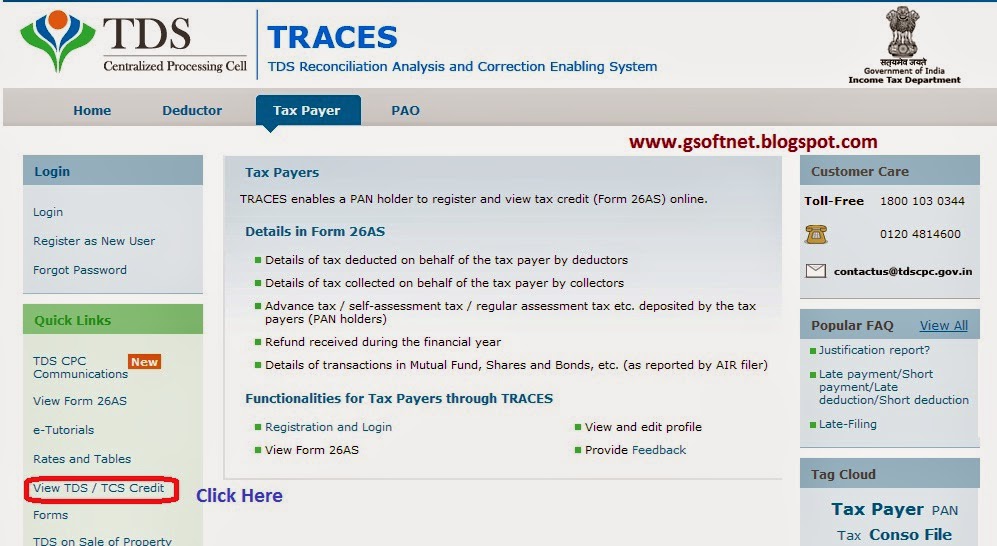

The TRACES has provided new advance features,

to view 26AS Statement or Tax Credit Statement for Asstt. Year 2014-15 without

register PAN No. With this features, Taxpayee can view their Tax Credit or For

26AS Statement by the providing of mandatory field i.e. PAN of Deductee*, TAN of

Deductor*, Financial Year*, Quarter* and Type of

Return* etc.

The following pictures are help you to view Tax

Credit Statement:

Tax Payer can View of their TDS/TCS Credit

w.e.f. Financial Year 2007-08 and onwards. To know whether your Deductor /

Collector has filed Quarterly TDS / TCS Statement and provided your PAN, provide

details as below:

Details provided by TRACES in Form 26AS as

under:

- Details of tax deducted on behalf of the tax payer by deductors

- Details of tax collected on behalf of the tax payer by collectors

- Advance tax / self-assessment tax / regular assessment tax etc. deposited by the tax payers (PAN holders)

- Refund received during the financial year

- Details of transactions in Mutual Fund, Shares and Bonds, etc. (as reported by AIR filer)

No comments:

Post a Comment