If you have forgotten your password and you have unsuccessfully tried other ways of resetting password, then you can use the new facility to get direct access to your Income Tax Department e-Filing account using the net-banking facility of your bank.

At this time the facility of direct e-Filing Login through Net banking is available through the following banks:

At this time the facility of direct e-Filing Login through Net banking is available through the following banks:

- Corporation Bank: https://www.corpretail.com/RetailBank or https://www.corpbank.biz/CorpBank/

- Union Bank of India: https://www.unionbankonline.co.in/

- Oriental Bank of Commerce: https://www.obconline.co.in/

The detailed steps are as follows -

- Taxpayer should be a registered user of Income Tax e-Filing Portal.

- Taxpayer should have already submitted the PAN details to the Bank. PAN is required to identify the taxpayer’s e-Filing account with the Income Tax Department.

- Taxpayer have to first go to the Internet/ Net / Online Banking website of the Bank which has already registered for this facility with the Department.

- Taxpayer after logging into his Net Banking account should select “Income Tax e-Filing Login” tab/menu item

- Taxpayer should Select the account number and enter the PAN for verification and click Submit

- Taxpayer should Accept the Rules and Regulations details

- Taxpayer should confirm that he may be redirected to his Income Tax Department e-Filing account - home page.

- Taxpayer can now rest his password and also avail of all services provided by the e-Filing Website of the Income Tax Department, including, filing his Income Tax Return.

Advantages of using this new facility

- Taxpayer gets direct access to his e-Filing account even if he has forgotten his password.

- Taxpayer gets a secure and safe way to login into his e-Filing account.

- Taxpayer can safeguard his e-Filing account by selecting/opting for “Password Resetting” only by using Digital Signature Certificate or through this new facility of direct login from his net-banking account, thereby preventing others from unauthorized access to his account. (coming soon….)

- Other benefits (coming soon…..)

Detailed steps using example of Corporation Bank Net banking

- Go to https://www.corpretail.com/RetailBank/ or any other Bank website from list above.

- Login in to your Corporation Bank Net banking account using your Bank provided User ID and password

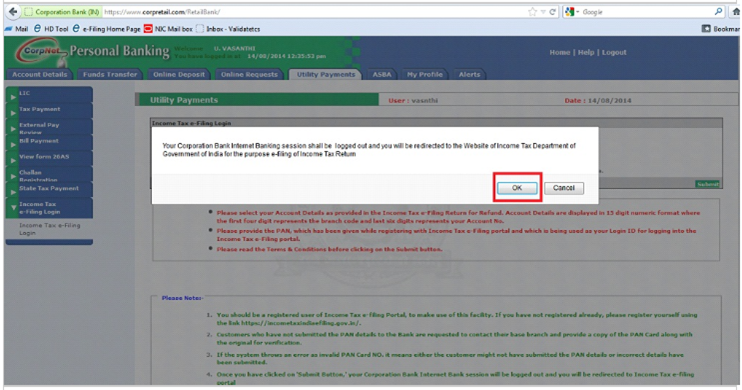

- In case of Corporation Bank -li Select Utility Payments > Select “Income Tax e-Filing Login”

- Select Account Number (IFSC Code) from the drop down

- Enter PAN

- Accept the Terms & Conditions

- Click on Submit

Click OK to get re-directed and automatically logged into Income tax Department e-Filing account (https://incometaxindiaefiling.gov.in)

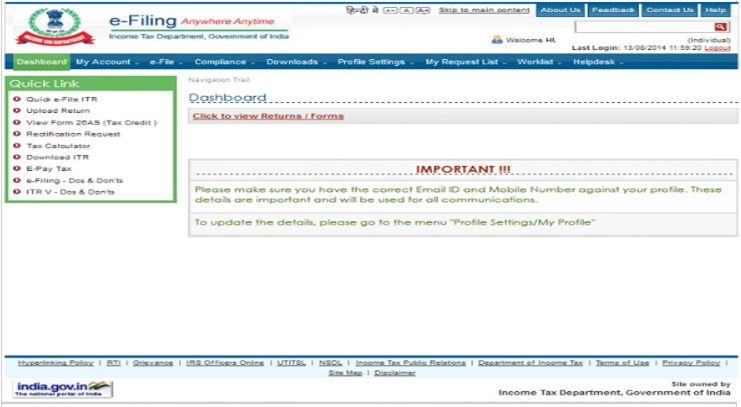

You will get re-directed to Income Tax Department e-Filing website (https://incometaxindiaefiling.gov.in) and the home page showing the “Dashboard” after login will appear.

e-Filing Portal Taxpayer Dashboard

You may now reset your password using “Profile Settings” or avail of any service offered.

Remember: This facility is a safe and secure method for direct login to your Income Tax Department e-Filing account only and is available ONLY through your Bank website after you have logged in and not through any other organization or entity or website.

Note: Your net-banking User ID or password is NOT shared by the bank with the Department.

No comments:

Post a Comment