Given below we discuss that after how difficult is the life for taxpayer and professionals from April 1, 2020 as there are number of changes going to be impacted to us.

-E-Invoicing w.e.f. 1st April 2020

-New Tax Return e.f. 1st April 2020

-Number of departmental notices

-Demands of interest for delayed filing of return

-Letters issued for Departmental GST Audit

-Annual Return in Form GSTR-9 and Reconciliation with books of accounts in Form GSTR-9C for the year 2018-19 duly certified by Chartered Accountant or Cost Accountant.

♦ E-Invoicing w.e.f. 1st April 2020 :

E-Invoicing will be introduced w.e.f. 1st April 2020 for taxpayers whose aggregate turnover (PAN India basis) is Rs. 100 Cr. Or more and trials have been already started on https://einvoice1-trial.nic.in/ & https://einv-apisandbox.nic.in/ for the taxpayers whose aggregate turnover (PAN India basis) is Rs. 500 Cr. Or more and sooner window for taxpayer whose aggregate turnover (PAN India basis) is Rs. 100 Cr. Or more will be started.

Meanwhile, Govt have nicely simplified the procedure and developed the offline tool, so as to prepare E-Invoice (Invoice, Debit Note & Credit Note) even without help of ASPs and GSPs. Although, this offline tool will be for limited period and meanwhile, each taxpayer can have its own API program to interact with Govt portal for E-invoicing. However, each company will have to undertake the following activities :

- Understanding exact legal aspect of the change.

- Review of the existing invoice format vis-à-vis proposed requirements.

- Identifying and understanding of changes required in ERP systems.

- Identifying the changes required in the business processes.

- Identifying the controls to be placed.

- Implementing the changes in processes.

- User Testing and sign off.

- Periodic check post implementation.

It is recommended to get acquainted through offline tool and wait whether there are any changes considering the earlier experiences and then only work on permanent solutions. Perhaps, development of own API program will be most cheaper, economical and permanent solution.

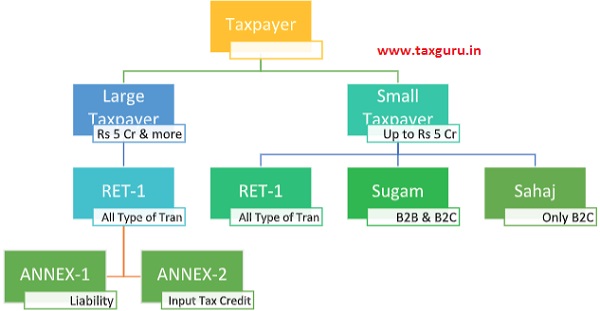

♦ New Tax Return w.e.f. 1st April 2020 :

All taxpayers have started receiving the advisory seeking the difficulties faced by the taxpayers during trials of filing the new tax return as follows :

After introduction of E-invoicing most of the transactions in Annexure 1 will be auto-populated and only the details of imports and transactions on which tax paid on RCM has to be uploaded. Similarly, almost each transaction in Annexure-II will be auto-populated and this will have to be accepted or rejected. Modification will not be possible until supplier amends the same. However, the taxpayer having turnover less than Rs. 100 Cr will have to upload all the transactions in Annexure-I (Outward Supply, imports and transactions on which tax paid on RCM). Suitable system needs to be developed.

Restricted ITC: After introduction of new tax return, earlier methodology of availing the ITC i.e. based on the invoice received or 120% of matched credit or 110% matched credit will not be in existence and there will not be credit availment by recipient, but it will be auto-credit in electronic credit ledger of the taxpayer based on accepted transactions appearing in Annexure-II of GST RET-1. Therefore, it will be utmost important for all the taxpayers to ensure regular matching of inward supplies with suppliers, uploading of returns (in other words, matching with GSTR-2A). It will be utmost additional work for all taxpayers to follow-up with the supplier either to amend the transactions, which are not been accepted by recipient or supplier have not uploaded such supply or there are errors in uploading.

Further, those suppliers who are opting GST “SUGAM” then, they will be filing the quarterly return and therefore, these transactions will appear only on quarterly basis and ITC will be locked for 2 months, which will have immediate liquidity issue. Every taxpayer will have to re-visit the supply chain strategy and strategy for selection of suppliers considering above aspects.

♦ Number of Departmental Notices :

It is important to note:

1. Centre sends out lakhs of GST recovery notices to 2.62 lakh taxpayers pan-India

2. Centre to assess taxpayers with mismatch of declared & paid liability; centre identifies Rs 36,000 Cr worth due to Centre on account of mismatch

3. Centre to ask taxpayers to refund Rs 37000 Cr where credits were taken on invoices for FY 18 & FY 19 but were time-barred

4. Centre To reach out the taxpayers for claiming more than 10% of credit due in GSTR 2A; estimates Rs 46,000 Cr of extra credit already availed by taxpayers

There are the cases, where there is a mismatch of the credit, department have issued number of notices in Form ASMT-10 asking the reason for mismatch and reverse the ITC in case of mismatch, but in accordance with provisions of Section 16(4) of CGST Act, 2017, ITC credit can be availed meeting the following conditions :

1. Goods and Services Receipts

2. Tax invoices in possession

3. Tax has been paid

4. GST Returns are filed

Provisions of Section 41 relating to matching was never been implemented till date and hence such notices not to have been issued.

Further, number of taxpayers have received the notices for claiming more than 20% / 10% credit i.e. matched transactions in GSTR-2A. Such notices are also unwarranted and circular / notifications restricted to such credit in contradiction with GST Law.

Majority of the notices even do not carry DIN number, which is mandatory.

Further, Indirect Tax Department has issued notices to thousands of companies that had claimed input tax credit under the goods and services tax framework after missing the deadline to do so and asked them to reverse the transaction. These companies had claimed the input tax credit for fiscal 2018 and 2019 after missing the September deadline. The tax department has asked them to reverse the transactions and pay interest on the wrongly claimed credit, people in the know said.

Input tax credit is a mechanism whereby companies can set off GST paid on raw materials or input services against future tax liabilities. “It is noticed that you have filed returns after the due date specified for availing (of) input tax credit for discharging your tax liability. You shall not be entitled to take input tax credit in respect of any invoice or debit note for supply of goods or services or both after the due date for furnishing of returns,”. Let us prepare for the same.

♦ Demands of interest for delayed filing of return :

As a matter of facts, Section 50 of CGST Act 2017 was amended on 1st Feb 2019 as follows :

(1) Every person who is liable to pay tax in accordance with the provisions of this Act or the rules made there under, but fails to pay the tax or any part thereof to the Government within the period prescribed, shall for the period for which the tax or any part thereof remains unpaid, pay, on his own, interest at such rate, not exceeding eighteen per cent., as may be notified by the Government on the recommendations of the Council.

Provided that the interest on tax payable in respect of supplies made during a tax period and declared in the return for the said period furnished after the due date in accordance with the provisions of section 39, except where such return is furnished after commencement of any proceedings under section 73 or section 74 in respect of the said period, shall be levied on that portion of the tax that is paid by debiting the electronic cash ledger.

(2) The interest under sub-section (1) shall be calculated, in such manner as may be prescribed, from the day succeeding the day on which such tax was due to be paid.

(3) A taxable person who makes an undue or excess claim of input tax credit under sub-section (10) of section 42 or undue or excess reduction in output tax liability under sub-section (10) of section 43, shall pay interest on such undue or excess claim or on such undue or excess reduction, as the case may be, at such rate not exceeding twenty-four per cent., as may be notified by the Government on the recommendations of the Council.

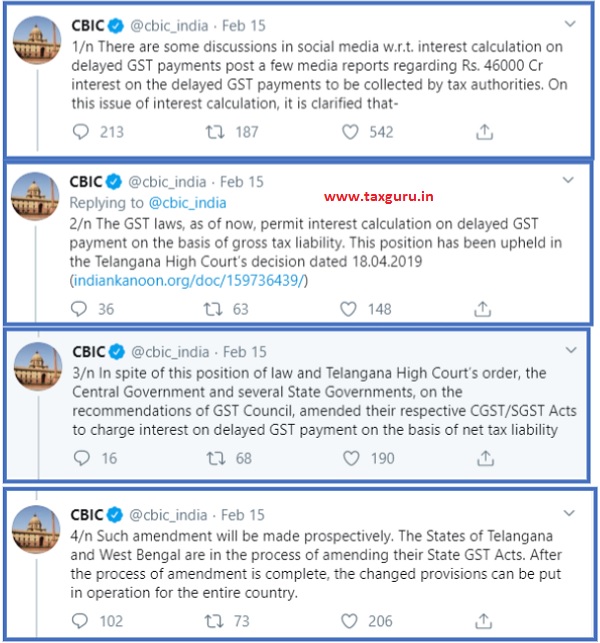

However, the date of the amendment for calculating the interest on net tax liability i.e. liability paid through cash has not been notified and departmental officers of GST have started issuing notices for delayed filing of returns on gross tax liability based on decision of Telangana High Court in the case of writ petition filed by M/s Megha Engineering and Infrastructures Limited.

Thereafter, it is important to read the tweets made by CBIC:

However, it is important to appreciate the decision of Madras High Court in the case of Refex Industries Ltd. Vs Assistant Commissioner of CGST & Central Excise (Madras High Court), wherein it has been held that

However, it is important to appreciate the decision of Madras High Court in the case of Refex Industries Ltd. Vs Assistant Commissioner of CGST & Central Excise (Madras High Court), wherein it has been held that

Quote

- Section 50 is specifically intended to apply to a state of deprival & cannot apply in a situation where the State is possessed of sufficient funds to the credit of the assessee. The proper application of Section 50 is one where interest is levied on a belated cash payment but not on ITC available with the Department to the credit of the assessee since the latter being available with the Department is neither belated nor delayed.

- The Hon’ble Madras HC further commented that the proviso to Section 50(1), as per which interest shall be levied only on that part of the tax which is paid in cash, has been inserted with effect from August 1st, 2019, but clearly seeks to correct an anomaly in the provision as it existed prior to such insertion and hence should be read as clarificatory and operative retrospectively.

- HC rejected reliance on the decision of the Telangana High Court in the case of Megha Engineering and Infrastructures Ltd. v. The Commissioner of Central Tax and others (2019-TIOL 893), noting that the amendment brought to Section 50(1), was only at the stage of press release by the Ministry of Finance at the time when the Division Bench passed its order and the Division Bench thus stated that “unfortunately, the recommendations of the GST Council are still on paper. Therefore, we cannot interpret Section 50 in the light of the proposed amendment”.

- Today, however, the amendment stands incorporated into the Statute and comes to the aid of the assessee.

Consequentially, the Writ Petitions were allowed, and the Impugned Notices were set aside.

Un-Quote

In view of the above, it is important to reply suitably after ascertaining the correct delay and interest @18% on tax liability paid through electronic cash ledger.

♦ Letters issued for Departmental GST Audit :

Number of taxpayers have received the letters in accordance with provisions of Section 65 of CGST Act 2017 for conducting the audit for the period July 2017 to March 2018 and in some cases, even till March 2019 even though annual return has not been still filed.

Huge information is sought, which includes:

List of Documents / Records Required to be submitted :

It is requested that the following documents (duly self-attested) may be furnished to this office :

(i) Annexure – GSTAM-I, Annexure – GSTAM-V and Annexure-GSTAM-VI as per the proforma prescribed in GST Audit Manual 2019

(ii) Copy of application for GST Registration, Registration Certificate(s)

(iii) Copies of GSTR-1, GSTR-2A, GSTR-3B and GSTR-9 and GSTR-9C alongwith payment challans

(iv) Details of E-Way bill for the audit period for inward and outward supply of goods and services

(v) List of Show Cause Notice issued, if any and their present status

(vi) Date of last Departmental Audit and the period covered. (Copy of the findings and correspondence with the department in this regards, if any)

(vii) Audit Report of the audit conducted by CERA, if any

(viii) Any other relevant records.

Statutory Documents / Records maintained under other laws for the time being in force :

(i) Copies of Annual Reports (with all schedules and notes to Accounts) , Balance Sheet, Profit & Loss Account Statement, Gross Trial Balance

(ii) Copies of Tax Audit Reports (including all annexures) conducted under Sec 44AB of the Income Tax Act 1961

(iii) Copies of Form 3CEB and 3CD Reports under Section 92E of the Income Tax Act 1961,

(iv) Cost Audit Report (If any)

(v) Copy of 26AS for the period of audit

Other documents / Records being maintained by you and required for verification of Input Tax Credit / Value of Goods & Services being provided / received by you :

(i) List of Input Service Suppliers, if any (including full details)

(ii) List of Capital Goods Suppliers, if any (including full details)

(iii) Input Tax Credit Ledger of ITC availed

(iv) Input Tax Credit Invoices

(v) Contracts, MOUs, Agreements with principals, clients, other group companies or any other person to whom any service is provided / received

(vi) A detailed note on the activities undertaken by you. This note should comprehensively cover all aspects of the activities including history of mergers / acquisitions, etc. This note should also include the activities of the company/group of companies (if any) in its entirety with separate note on the registered concern proposed to be verified.

(vii) List of Branch offices, if any alongwith the respective value of taxable services / sales rendered by each of such branch

(viii) Copy of TRAN-1 return for verification

(ix) Summary of taxes (Service Tax/Central Excise/GST) paid (Cash & Cenvat / ITC) during the relevant audit period including value of taxable service.

(x) List of records as per Annexure B

Part I – Goods :

I. Records related to the marketing and outward supplies

1. Purchase orders

2. Price Circulars

3. Delivery Challans

4. Material Transfer Note

5. Sales Book

6. Outward Supply Book

II. Record related to the stores (Where applicable)

1. Stores Ledger

2. Goods Receipt Note / Material Receipt Note/Inspection cum Receipt Report (ICRR)

3. Material Return Note

4. Rejected Goods Register

5. Waste Register

6. Physical Stock Verification Statement

7. Job Work / Sub-Contract register

III. Finance & Accounts related Records:

1. Ledgers

2. Debit Note

3. Credit Note

4. Journal Voucher

5. Internal Audit Reports

6. Purchase Book

7. Purchase Return Book

8. Income Tax Audit Report

9. Income Return

10. Fixed Assets Register

11. Monthly Stock Statement to Bank

Part II – Supply of Services:

I. Records Related to Marketing and Sales Department

1. Purchase Orders / Agreements / MOUs

2. Outward Supply Book

II. Records Related to Stores Department

1. Stores Ledger

2. Job Work / Sub Contract Register

III. Records Related to Finance & Accounts related Records:

12. Ledgers

13. Debit Note

14. Credit Note

15. Journal Voucher

16. Internal Audit Reports

17. Purchase Book

18. Purchase Return Book

19. Income Tax Audit Report

20. Income Return

Further, they have sought the information in Form GSTAM-V and Annexure-GSTAM-VI as prescribed in GST Audit Manual 2019, which provides various questionnaire on internal control system w.r.t. Purchases- inward supplies, outward supplies, stores, Tax Accounting, Job Work, supply of service, invoicing system, accounts and records , making of GST returns place of supply valuation of services & MIS and also provided a walk through which will be useful for implementing the better system and department is seems to walk through such system prevailing with tax payer. Moreover, taxpayer will have to provide the data of various items of financial statements including turnover, quantity manufactured and cleared, GST paid through ITC and cash, various details of consumption of inputs, wastages, Power & Fuel and write off as reflected in financial statements, records maintained under CGST Act & Rules, Annual Return, Cost Audit Report, Income Tax Audit Report (Tax Audit Report) , Trial Balance & Balance Sheet and P&L Account.

All of you are aware department will seek the information and make life difficult and taxpayers will be busy in compliances rather than focusing on business.

♦ Annual Return in Form GSTR-9 and Reconciliation with books of accounts in Form GSTR-9C duly certified by Chartered Accountant or Cost Accountant.

Last date of filing of Annual Return in Form GSTR-9 and Reconciliation with books of accounts in Form GSTR-9C duly certified by Chartered Accountant or Cost Accountant is 31st Dec 2019, but there will be no relevance of last date loose when Utility released for GSTR-9 & GSTR-9C for FY 2018-19 having following errors:

- Summary of GSTR-2A, 3B & GSTR 1 not coming properly

- only Table 4, 5, 6 and 9 have data and rest all are showing errors

- Trans 1/2 credit is reappearing

- GSTR 9 and 9C Return need lot of modifications.

- The biggest problem is that No effect of table 10 11 12 13 14 of 17-18 in 18-19.

- There is no separate rows given in 18-19 Form. So Form design need radical changes. E.g. There is no where we deduct ITC of 17-18 but claimed in 18-19, To arrive correct ITC of 18-19 because GSTR 3B ITC of 18-19 might contains ITC of 17-18 as well as

- Also same logic for outward, because we might have tax paid in 18-19 Which is of 17-18 liability.

- Table 8 Data of GSTR 2A figure not appearing.

- Trans 1 credit is reappearing in table 6. How is that possible?

- No clarity on tables, which was optional in GSTR9 and GSTR 9C. Whether such option will continue or not?

Similarly, utility for filing GSTR-9C is yet to be ready. Therefore, how to meet the deadline, will be the challenge for each taxpayer and Chartered Accountant OR Cost Accountant.

Let us be ready for meeting above challenges, since taxpayer will have to decide the focus on compliances or focus on business or select alternative resources to achieve both objectives.

No comments:

Post a Comment